How did national events affect the brewery at 30 East Saint Helens Street?

Brewing played a vital part in the history of 30 East Saint Helens Street, beginning in 1647 and lasting for over 1½ centuries. Over the course of a week in July 2021, we had the assistance of Ianto Brewer, a Sixth Form History student from Abingdon School. He investigated why the brewhouse situated adjacent to the dwelling house ceased to exist after 1799.

Brewing at 30 East Saint Helens Street was started by Thomas Hulcott in 1647 and developed uninterrupted until 1700 when Thomas died. His daughter Hannah Hulcott was able to continue the business. Sometime before 1704, Hannah married William Hawkins, a local man of established wealth and they commissioned the building of the Queen Anne style front house at No. 30. (What we see today is more Georgian in style, the result of additions made in Victorian times; and even in 1930 we find legal correspondence referring to a Queen Anne’s bounty of £3.3.0 – three pounds, three shillings and zero old pence).

So how did brewing at No. 30 cease to exist just a century after the front of house was built?

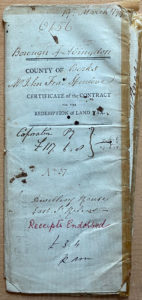

Following the Seven Years’ war (1756-1763) and Britain’s continued aggressive foreign policy brought about by involving themselves in the French Revolution of 1792, a crippling national debt had developed by 1798 of £462,000,000. This had to be addressed according to the view of the time and resulted in an Act of Parliament that turned land tax into a perpetual charge that could only be overturned if a lump sum was paid, via Commissioners, to the Bank of England (in the picture: the Certificate of the Contract for the Redemption of Land Tax). Or, in the language of the time “An Act for making perpetual, subject to redemption and purchase in the manner therein stated, the several sums of money now charged in Great Britain as a Land tax for one year, from the twenty-fifth of March one thousand and seven hundred and ninetyeight”

Following the Seven Years’ war (1756-1763) and Britain’s continued aggressive foreign policy brought about by involving themselves in the French Revolution of 1792, a crippling national debt had developed by 1798 of £462,000,000. This had to be addressed according to the view of the time and resulted in an Act of Parliament that turned land tax into a perpetual charge that could only be overturned if a lump sum was paid, via Commissioners, to the Bank of England (in the picture: the Certificate of the Contract for the Redemption of Land Tax). Or, in the language of the time “An Act for making perpetual, subject to redemption and purchase in the manner therein stated, the several sums of money now charged in Great Britain as a Land tax for one year, from the twenty-fifth of March one thousand and seven hundred and ninetyeight”

The Bank of England deemed this to be a necessary strategy, but it was the breaking point for many businesses.

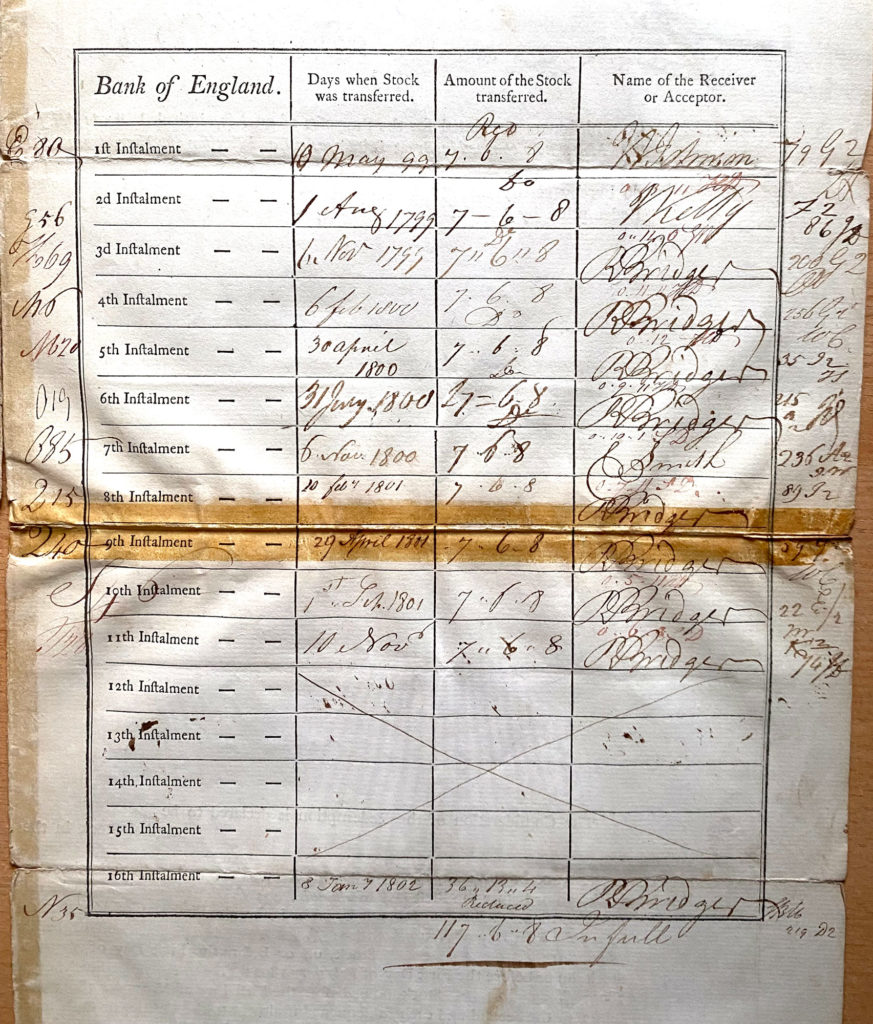

The lump sum equates to 37 years’ worth of land tax. I was collected in up to 16 instalments. In the case of our brewery, the last brewer, Mr John Fras Spenlove, chose to make 11 payments of £7.6.8 followed by a (reduced) final payment of £36.13.4. These calculations were based on a land tax of £3.4.0 which was assessed on the brewery operations. The total paid was £117.6.8. In terms of prices, that converts to over £9,000 in today’s money, or the equivalent of 11 horses or 23 cows in 1798 (valuable commodities of the time). However, in terms of wages, inflation was higher. It is £63,000 if we assume £10/hour today. The payment of this lump sum required the selling or re-allocation of all the beer making equipment (Mr Spenlove, had 9 breweries in Abingdon and there were many breweries in Abingdon making competition tough. Abingdon’s Moorland Brewery had been operating since 1711).

To conclude, in 1799, external events led to the termination of brewing in the yard at No. 30. The enormous National Debt gave rise to changes in land tax laws. The decision was made by Mr Francis Spenlove, brewer, to make a lump sum payment, therby preventing a perpetual stress on the subsequent occupiers and eventual owners of 30 East Saint Helen Street. Intriguingly, the words Receipts Endorsed are written in biro on the document – it still had legal interest well into the 20th Century.

This article is based on the project work of Ian Brewer, who was attached from Abingdon School in July 2021.